In 2026, many homebuyers are still surprised to see mortgage applications rejected despite having an Agreement in Principle (AIP). An AIP can feel like approval, but in reality it is only an early indication based on limited checks.

This article explains why applications fail after an AIP, what lenders reassess at full application stage, and how buyers can reduce the risk of rejection.

What an Agreement in Principle Actually Confirms

An AIP is typically based on declared income, estimated outgoings, and a preliminary credit check. It does not involve full document verification, stress testing, or property assessment.

Once a full application is submitted, lenders replace assumptions with evidence.

Affordability Is Tighter in 2026

Lenders continue to apply cautious affordability models in 2026. Rising living costs mean disposable income is scrutinised more closely than ever.

- Car finance and PCP agreements reducing borrowing power

- Credit card balances and personal loans

- Childcare, subscriptions, and lifestyle costs

- Stress testing at higher interest rates

Credit Behaviour After an AIP

Credit scores alone do not guarantee approval. Lenders focus on recent behaviour and changes made after an AIP is issued.

- New credit taken out after the AIP

- High credit utilisation

- Overdraft reliance

- Recent missed or late payments

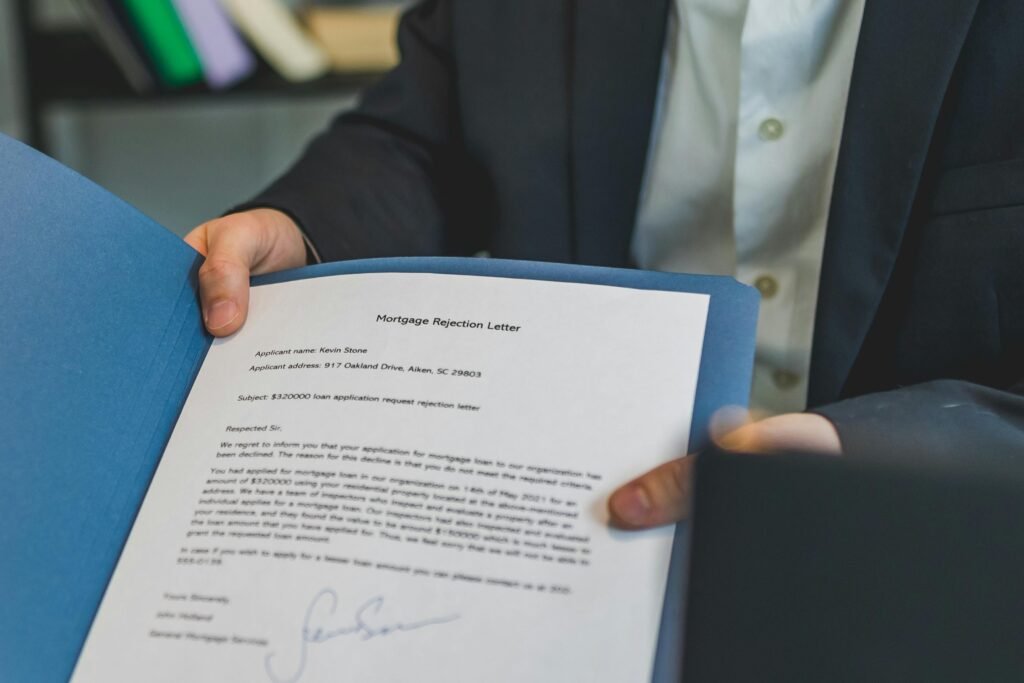

Property and Valuation Issues

Mortgage approval depends on the property as much as the buyer. Short leases, high service charges, non-standard construction, and down-valuations remain common causes of rejection.

Income Evidence Problems

Variable income, self-employed earnings, bonuses, and commission are assessed conservatively. If documentation does not align with lender criteria, applications can fail late in the process.

How to Reduce the Risk of Rejection

- Stabilise finances before applying

- Avoid new borrowing after an AIP

- Prepare documents early

- Match the lender to your circumstances

Speak to NexGen Finance

NexGen Finance can review your position and, where appropriate, introduce you to an authorised mortgage adviser before you apply.